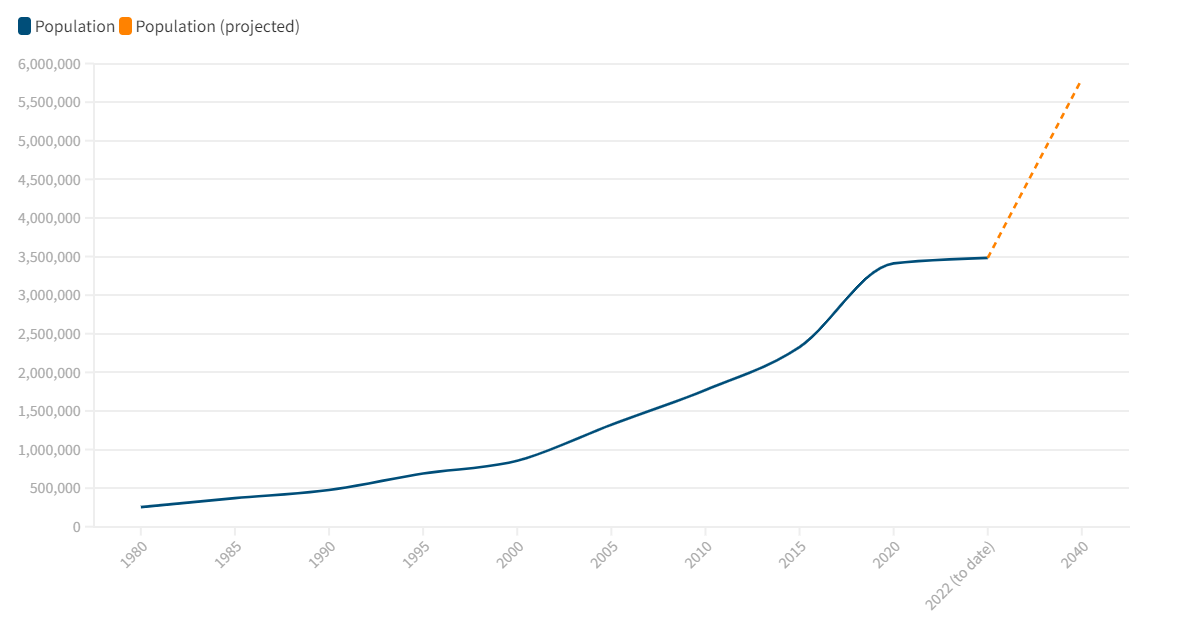

Dubai population to surge to nearly 6m in 20 years amid urban transformation

Emirate nears population of 3.5m and is expected to reach 5.8m by 2040

The population of Dubai is projected to nearly double in the next 20 years, according to experts who predict a fresh wave of post-pandemic immigration.

Experts anticipate the growth will drive the need for new schools and hundreds of thousands of new homes, with some new arrivals expected to be from Russia and Sub-Saharan Africa.

Dubai Statistics Centre’s population counter, which records growth using residency visa data, stood at 3.48m this week – and looks set to hit 3.5 million within weeks or months.

I’m predicting the population of Dubai is to double again in the coming 10 years

Prof Philippe Fargues, European University Institute

The GCC recorded a four per cent fall in population over 2020, due to the Covid-19 outbreak, with Dubai experiencing the largest decrease at 8.4 per cent. But the city appears to have already bounced back from that. Today, the population is nearly 100,000 higher than in January 2020.

In anticipation of the growing population, Sheikh Mohammed bin Rashid, Vice President and Ruler of Dubai, last year, unveiled the 2040 Urban Master Plan. It aims to transform the emirate, making it more sustainable and interconnected to cater to an expected population of 5.8m.

The National spoke to several leading population growth experts and compared Dubai government statistics with the emirate's exponential development.

Population growth in Dubai

The discovery of oil kick-starts development in Dubai and the UAE

In 1950, the population of what is now the UAE was just 70,000, less than a fifth of what it had been at the beginning of the 19th century. The pearl industry’s collapse had caused the population to dwindle.

However, the discovery of oil from the late 1950s onwards heralded the start of what would become development on a vast scale.

“Lots of economic and institutional development took place in the late 50s and early 60s ... That increased the population from a very low population,” says Dr Aqil Kazim, an assistant professor at UAE University in Al Ain.

“The more development that took place in the UAE, that led to an increase in the population because of the demand on labour to work in different sectors that are developing.”

By 1970, the UAE’s population was up to 226,000 and just five years later had more than doubled to 560,000. Fast forward another five years and, with soaring oil prices fuelling the development of infrastructure and the need for foreign labour and expertise, it was above one million.

Economic diversification continues growth

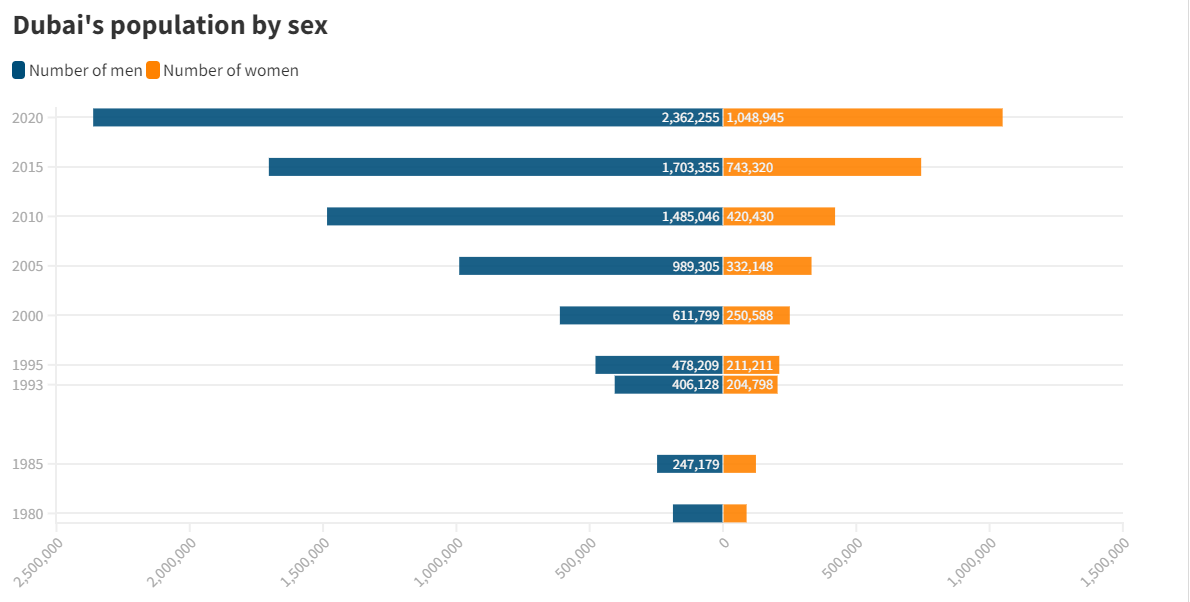

The 1980s saw one million added to the UAE’s population tally, with initiatives such as the building of Jebel Ali Port, launched in 1979, furthering economic growth and diversification. Another one million increase was recorded during the 1990s, bringing the population up to 2.9 million in 2000. Younger male workers came – principally from across Asia – skewing the population towards foreign men.

Dubai's population by sex

“Later on, oil was not a factor for population increase,” says Dr Kazim. “Dubai became a re-export centre in the region, from Central Asia, Africa, the Middle East, all of these regions became dependent on Dubai re-exporting products. Most of the companies in the world started to base themselves in Dubai.”

The first decade of the new millennium saw development and population growth at a lightning pace as the economy grew, with the UAE’s population reaching 4.1 million in 2005, before doubling in five years to 8.25 million in 2010. By 2015, the country was home to 10.8m people.

“UAE real estate played a big role, services played a big role, Dubai airport, Sharjah airport, Abu Dhabi airport – these are all international airports, and Dubai port,” Dr Kazim says.

“Dubai started to sell land to foreigners, to expats, to everybody who wanted to buy from around the world. Dubai land became a global commodity for sale … Those who could afford to buy condominiums and houses and villas in Dubai, they became resident. They settled down. They love to live here.”

While the Emirati population has continued to grow – with birth rates well above replacement levels – it has expanded much more slowly than the number of foreign workers and now makes up about 11 per cent of the total population.

What the future holds UN forecasts suggest the UAE population will continue to grow. Now around 9.4m, the country’s population is predicted to be around 11.1m in 2030, 13.2m in 2050 and 14.8m in 2100.

While still a high level of growth, in percentage terms these forecasts represent a significant decrease on what has been seen until now.

“Up to 2014, every decade brought a doubling, roughly speaking, of the population in Dubai. I don’t think this doubling is going to last,” says Dr Frederic Schneider, a senior research associate at the University of Cambridge’s Judge Business School, who will soon take up a post at the University of Birmingham Dubai.

.jpg)

Dubai developed according to an American model with spread-out districts and heavy reliance on cars. Despite investment in public transport, including the Metro, the large distances involved in travelling within the city may limit continued growth, suggests Dr Schneider.

The UAE has, he says, made “massive efforts” to attract talented, high-productivity workers as the authorities look to shift the economic focus away from low-productivity migrant labour to other fields that generate more economic activity per capita.

“There’s this push for high-value expats, so you have the golden visa and citizenship programmes,” says Dr Schneider.

While Dubai and the UAE are looking for continued growth, so are neighbours – notably Saudi Arabia and Qatar – so competition to attract the brightest and best foreign workers may intensify.

“People will have a choice where they want to go if they want to go to the Gulf,” says Dr Schneider.

Indeed, not every observer is convinced that population growth will continue at all. Prof Philippe Fargues, director of the migration policy centre at the European University Institute, and co-editor of the book Migration from North Africa and the Middle East, says the population of non-Emiratis could even decline amid Emiratisation efforts.

“That is a scenario that should be considered,” he says. “Dubai has been an extremely fast-growing city, but we don’t know if that will continue.”

There is a wide range of views among experts on how the population will change. The growth of Dubai as a retirement centre, and the need for workers to cater to the requirements of retirees, is one factor causing Dr Kazim to expect continued population growth.

“I’m predicting the population of Dubai is to double again in the coming 10 years,” he counters.

Where will foreign workers come from in future and what will they do?

As Prof Fargues puts it, “migrants move along roads that are charted by former migrants”, so he does not expect major changes in the composition of the UAE’s foreign worker population.

“It’s very much a matter of networks,” he says. “So, the main origins may not change very much.”

This means that many residents of the UAE are likely to continue to come from South Asia. Sub-Saharan Africa, while set for huge population growth of its own, is not expected by Prof Fargues to be a major source of emigration to the Gulf.

Dr Schneider suggests that Russians may be attracted to the Gulf, especially if President Vladimir Putin’s grip on power loosens and wealthy citizens “are in need of a safe haven”.

There is also a large “potential influx to the Gulf” of Iranians, although this depends upon how bilateral ties develop.

“Most professions are already represented, from unskilled labour to engineers and medical doctors,” says Dr Schneider. “Certainly, there is a shift in composition in many professions. For example, we’ve seen a certain shift away from fellow Arab citizens (Egyptian, Palestinian) in the K-12 education sector.”

The four key non-oil sectors – logistics, finance, tourism and construction – will all remain important employers, but Dr Schneider predicts a fall in the number of unskilled migrant workers from South Asia as that sector cools. They may be compensated for by an increase in the number of unskilled service industry workers, such as delivery drivers.

“We can expect education to increase,” says Prof Fargues. “And the labour market that is linked to rising levels of education – universities, high schools … That will continue to increase.”

.jpg)